In 2025, personal finance tools have become smarter, more secure, and easier to use than ever before. Whether you’re a student, a small business owner, or managing a household, budgeting apps are now an essential part of financial success. In this guide, we’ll explore the Top 5 Budgeting Apps USA 2025, their features, benefits, and why they might be the perfect fit for your financial goals.

Why Budgeting Apps Matter in 2025

Budgeting in 2025 is no longer just about spreadsheets or notebooks. With the rise of artificial intelligence, automation, and real-time syncing with your bank accounts, today’s budgeting apps are highly sophisticated tools that empower users to take control of their money. They offer customized advice, spending alerts, savings goals, and even investment tracking all in one place.

As the economy grows more dynamic and digital payments become the norm, budgeting apps are no longer a luxury they’re a necessity. That’s why identifying the Top 5 Budgeting Apps USA 2025 can make a meaningful difference in how you manage your finances this year.

How to Choose the Best Budgeting App for You

Before jumping into the top picks, it’s important to understand what to look for in a budgeting app:

- Ease of use: An intuitive interface is crucial, especially for beginners.

- Automatic syncing: Apps should connect securely with your bank, credit card, and loan accounts.

- Custom categories: You should be able to categorize your spending in a way that reflects your lifestyle.

- Goal setting: Apps should help you set and track goals like saving for a trip or paying off debt.

- Cost-effectiveness: Free apps are great, but sometimes paid versions offer serious value.

With these criteria in mind, let’s dive into the Top 5 Budgeting Apps USA 2025.

Top 5 Budgeting Apps USA 2025: Reviewed

1. YNAB (You Need A Budget)

Best for: Serious budgeters and long-term planners

Platform: iOS, Android, Web

Cost: $14.99/month or $99/year (free trial available)

Key Features:

- Zero-based budgeting model

- Real-time syncing with all devices

- Goal setting, reports, debt payoff planning

- Excellent customer support and educational resources

Pros:

- Helps develop healthy money habits

- Highly customizable

Cons: - Takes time to learn for beginners

2. Mint (by Intuit)

Best for: Beginners and all-around users

Platform: iOS, Android, Web

Cost: Free (with ads); Premium version available

Key Features:

- Automatic expense tracking

- Bill payment reminders

- Credit score monitoring

- Categorizes transactions instantly

Pros:

- User-friendly and free

Cons: - Ad-supported interface

- Some syncing delays with banks

3. PocketGuard

Best for: Quick tracking and daily use

Platform: iOS, Android

Cost: Free basic version; $7.99/month for premium

Key Features:

- “In My Pocket” shows how much spendable cash is available

- Helps avoid overspending

- Tracks subscriptions and recurring charges

Pros:

- Simplifies budgeting for busy people

Cons: - Limited features in the free version

4. Goodbudget

Best for: Couples or shared household budgeting

Platform: iOS, Android, Web

Cost: Free version; $8/month for premium

Key Features:

- Envelope-based budgeting system

- Manual entry for spending

- Cloud sync across devices

Pros:

- Great for shared budgets

Cons: - Manual input can be tedious

5. Empower (formerly Personal Capital)

Best for: Investors and high-income earners

Platform: iOS, Android, Web

Cost: Free (investment advisory services available)

Key Features:

- Tracks net worth and investment portfolios

- Retirement planning tools

- Expense tracking and budgeting dashboard

Pros:

- Comprehensive wealth management

Cons: - More focused on investments than budgeting

These picks represent the Top 5 Budgeting Apps USA 2025 across a range of user needs, from total beginners to financial veterans.

Affordable Health Insurance USA 2025 | Best Budget Plans

Best Free Budgeting Apps in the USA 2025

If you’re looking to budget without spending a dime, here are some of the best free options:

- Mint: Great for beginners, easy to use

- PocketGuard (Free Version): Ideal for quick daily money tracking

- Goodbudget (Free Plan): Good for couples who want to try envelope budgeting

Free apps do have limitations, fewer customization options, ads, and limited reporting. But for many users, they are more than sufficient.

Top Budgeting Apps for Specific Users

For College Students:

- PocketGuard (free version works well)

- Helps track spending and avoid overdrafts

For Parents and Families:

- Goodbudget

- Helps manage household expenses together

For Freelancers:

- YNAB

- Excellent for planning with irregular income

For Retirees:

- Empower

- Combines budgeting with wealth tracking for fixed incomes

This user-specific guide within the Top 5 Budgeting Apps USA 2025 helps every category of user find their perfect match.

Are Budgeting Apps Safe in 2025?

Yes, most reputable budgeting apps use bank-grade encryption, two-factor authentication, and read-only access to your financial data. Still, users should:

- Check privacy policies

- Use strong passwords

- Regularly update apps

- Avoid unknown or non-certified apps

Always download apps from verified sources (Apple App Store or Google Play).

Top 5 Budgeting Apps USA 2025

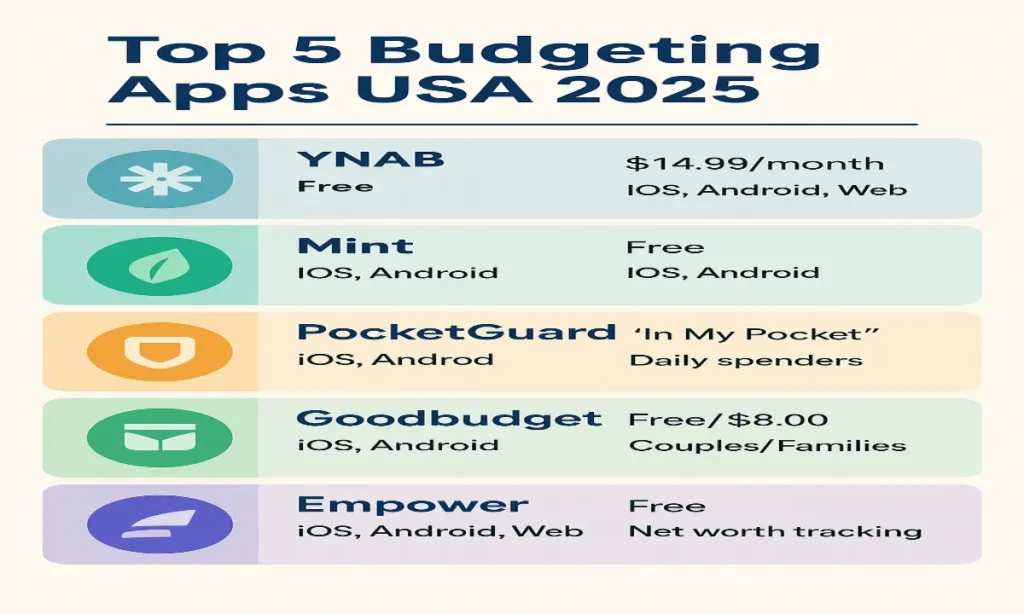

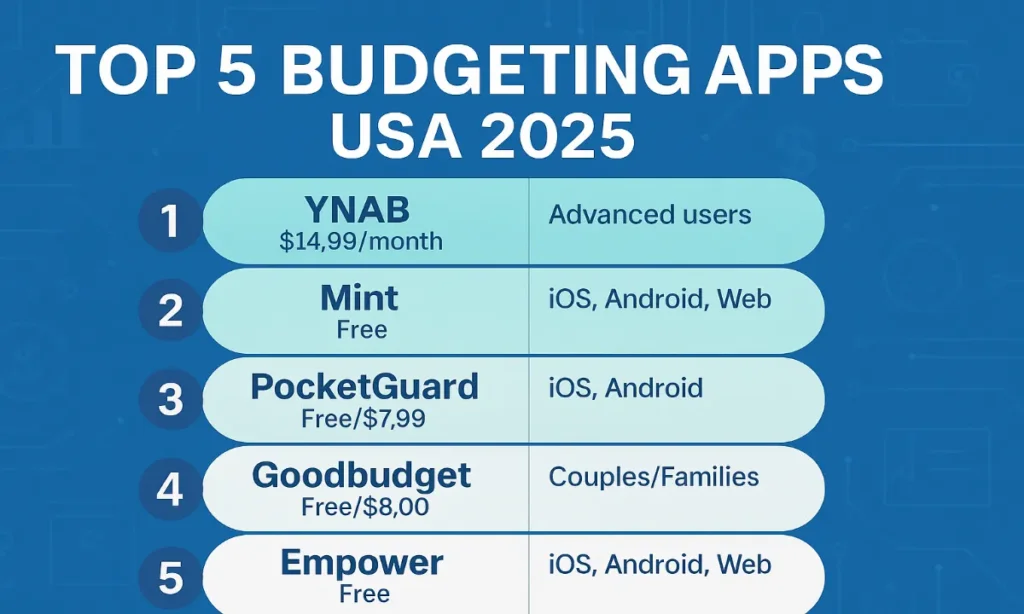

| App Name | Price | Platform | Best Feature | Ideal For |

| YNAB | $14.99/month | iOS, Android, Web | Goal-based budgeting | Advanced users |

| Mint | Free | iOS, Android, Web | Auto transaction categorization | Beginners |

| PocketGuard | Free/$7.99 | iOS, Android | “In My Pocket” feature | Daily spenders |

| Goodbudget | Free/$8.00 | iOS, Android | Envelope budgeting | Couples/Families |

| Empower | Free | iOS, Android, Web | Net worth tracking | Investors/Retirees |

Which Budgeting App is Best in 2025?

While each app has its strengths, here’s our recommendation based on user type:

- Best Overall: YNAB

- Best Free App: Mint

- Best for Simplicity: PocketGuard

- Best for Shared Budgeting: Goodbudget

- Best for Wealth Tracking: Empower

Choosing from the Top 5 Budgeting Apps USA 2025 depends on your goals saving money, eliminating debt, or planning for retirement. No matter your goal, the right app can help you take control of your financial future.

Conclusion

From AI powered insights to daily spend tracking, the Top 5 Budgeting Apps USA 2025 offer a wide range of solutions for every kind of budgeter. Whether you want to stop living paycheck-to-paycheck or optimize your investments, these tools are here to support your journey.

FAQs

What is the best budgeting app in 2025?

YNAB tops the list in 2025 for its detailed budgeting system, real-time tracking, and goal-setting features.

Are budgeting apps free to use?

Many apps like Mint, Pocket Guard, and Good budget offer free versions with optional premium features. Top 5 Budgeting Apps USA 2025

Can budgeting apps help me pay off debt?

Absolutely. Apps like YNAB and Good budget are designed to help you prioritize debt repayment through goal tracking and smart spending plans.

Are budgeting apps safe for linking my bank account?

Yes, top apps use strong encryption and only allow “read-only” access, meaning they can’t move your money or make transactions.

Can couples use budgeting apps together?

Yes! Apps like Good budget are designed for shared financial planning across multiple devices.