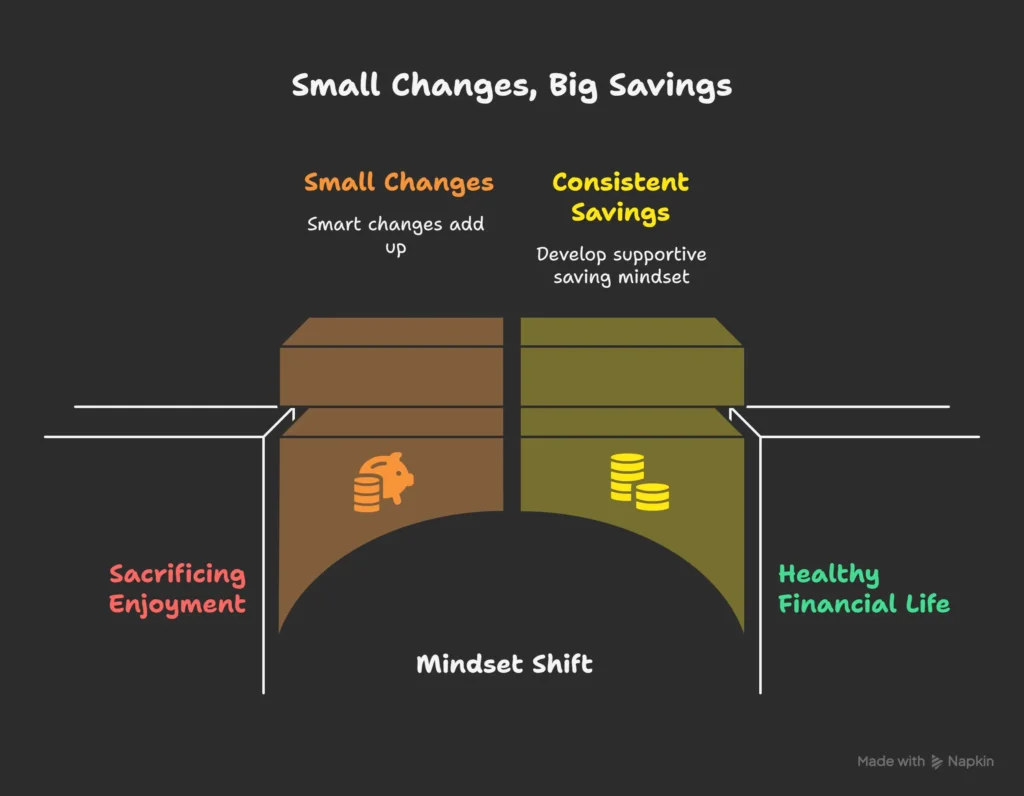

When we think about saving money, the initial thing that most of us tend to do is think about wonderful sacrifices. “I need to cut out my morning coffee,” or “I can cut out Netflix and never go out to eat again.” Come on though, cutting something out that you really love just doesn’t really result in long-term gains. The reality is, cutting out your morning coffee isn’t required in an effort to create a healthier money lifestyle.

This is a blog post on how to alter the way you save. It’s about making small, intelligent changes that pay off in the long run and having a mindset that emphasizes saving consistently. If you are paycheck to paycheck or just want to save more consciously, this mindset shift could be a lifesaver.

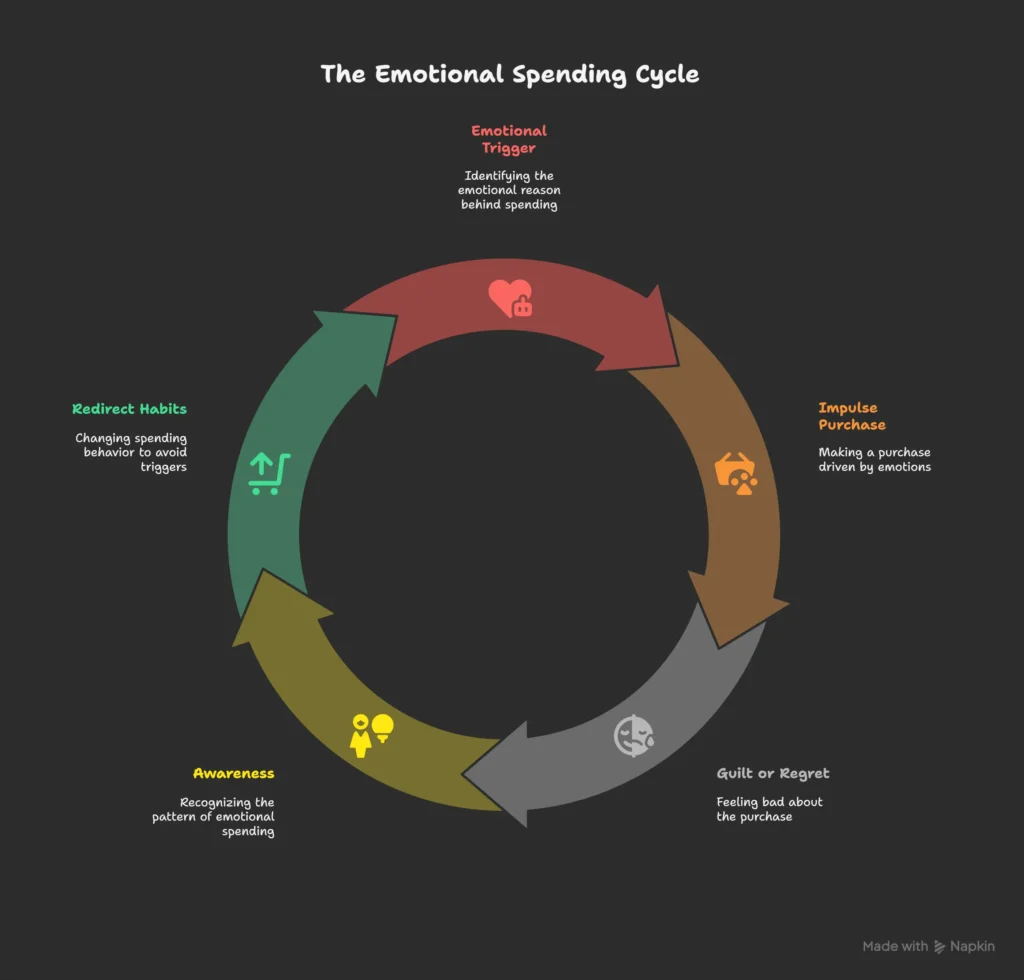

The Psychology of Spending: Why We Overspend.

Our purchase is as emotional as a rational one. We buy in a bid to feel good, to release tension, or as a treat. That is what the advertisers know, and they create products and offers that will get us to respond on a level of emotion. That is why impulse purchases are such a phenomenon.

Rather than guilt-tripping yourself into not spending, it is worth discovering the emotional impetus for your spending choices. Are you overspending when you are anxious? Eating out because you’ve had a victorious day at the end of a hectic week? If you can recognize those triggers, you can correct your behavior without depriving yourself.

The Power of Small Changes That Compound

But the good news: you don’t have to change overnight. Actually, small changes made consistently have a bigger impact over time than huge sacrifices all at once. It’s the compound effect.

Let’s make that stick:

- Meal prepping for a week = save $3 on a meal, 4 times a month = $12

- Canceling an unused subscription = $10/month

- Cashback grocery apps = $10/month

- Turn off lights and cut back on AC use = $8/month

- Pack lunch instead of eating at a restaurant = save $5/week = $20/month

- Cut back on online shopping indulgences = $10/month

- Carpool or public transportation weekly = $15/month

- Negotiate a bill = $15/month

Total Savings: $100/month

And you never gave up coffee once. This way feels less daunting and provides assurance. Every small victory builds more momentum.

Why Big Sacrifices Are Often Unsustainable

Dramatic changes will seem to be getting along initially, but they have too much opposition and tension. Forgoing everything that you love makes you feel inadequate. It may lead to burnout and excess in the long term.

Imagine budgeting as dieting. Strict diets do not work because they cut back too drastically. But incremental additions such as drinking more water, consuming more vegetables, and regular walks create lasting effects. The same applies when it comes to saving.

Rather than quitting cold turkey on your indulgences, find natural shifts. That is the secret to a lasting budgeting plan.

Having a Growth Mindset About Money

A fixed mindset requires: “I’m just bad with money.” A growth mindset requires: “I can learn to handle money better.”

Shifting your money attitude begins where you begin, in the way that you talk:

- Rather than: “I can’t afford that,” say: “That’s out of my budget right now.”

- Rather than: “I never have money,” say: “I’m getting better at handling and keeping track of my money.”

- Instead of: “I’ll never be able to save,” use: “Each penny that I save is going in the right direction.”

Your words create your beliefs, and your beliefs create your actions.

Daily Habits to Assist the Mindset Shift

These are easy habits to assist the mindset shift:

- Daily money check-in: Journal or sweep through your spending in 3 minutes.

- Gratitude practice: List 3 things you already have that you’re thankful for. It dashes the desire to overspend.

- Track spending: Record every nonessential purchase. You’ll be more aware.

- Assign weekly savings goals: Attempt incremental saving per week ($10, $20, etc.).

- Visualize your goal: Make a savings chart or vision board.

These small habits sum up to money awareness and intention.

Celebrate Small Wins to Get Going

Earned $10 last week? That’s something to brag about. Every dollar counts, and every praise gets you going. Indulge yourself, dine out, or just be proud of how far you’ve come.

Save first before you brag. The journey is as good as the trip.

Real-Life Example: Sarah

Sarah, age 26 and an author, had been wasting her money. She thought of herself as only “bad with money.” Tracking her expenses for 30 days, she discovered habits: weekly takeout, unused subscriptions, and spontaneous Amazon purchases.

Instead of cutting back on everything, she made minor changes:

- Cooked two nights a week

- Cut 3 unused subscriptions

- Impose a weekly spending limit

After 3 months, Sarah saved $320—and was still able to enjoy her daily iced coffee.

FAQ: Small Changes & Mindset Shift for Saving Money

Is it really possible to save $100/month through small changes?

Yes. Little by little, quickly mounts up. It only requires saving $3.33/day to save $100 in a month.

Isn’t not having coffee literally not necessary to save money?

Yes. If your coffee is an emotionally satisfying source of comfort and happiness for you, then go ahead and keep drinking it. Cut other spending that isn’t emotionally driven.

How long before one feels the effects of these changes in mindset?

Some are immediate (e.g., cancelling a subscription), some grow exponentially after weeks. Consistency is the aim.

I failed previously at saving. How do I maintain motivation now?

Begin slowly, monitor your progress, and improve without striving for perfection. Reward yourself when you reach your milestones.

Do I need to have a budget to begin saving this way?

No, not really. Just monitoring your spending or using budget software will suffice. A full budget is useful, but is not required to begin.

How do I know what small changes to make?

Begin by monitoring your spending for 30 days. Identify 3-5 areas where you can save a little with minimal effort.

Can I still enjoy living while saving money?

Yes! And there’s actually an added benefit: you can enjoy your spending more because it’s intentional.

For More Updates Visit: https://fastinsuree.com/category/smart-living/