Introduction

Determining the optimum auto insurance for young drivers in the USA in 2025 is more critical than ever with increasing premiums, the number of vehicles on the road, and altered driving habits among Gen Z drivers. For young drivers, aged between 16 to 25 years, the issue is to find a balance between affordability and sufficient coverage. Young drivers tend to be considered high-risk by insurance companies due to their short driving experience and higher accident likelihood.

Premiums are therefore typically higher, although several providers have now accommodated this group by designing policies specifically for them that include discounts, payment plans that can be flexible, and usage-based insurance plans that track driving behavior through telematics. In 2025, leading insurance firms such as GEICO, State Farm, Progressive, Allstate, and Nationwide have launched new packages that offer affordability, technology support, and inclusive coverage options.

For example, most have good student discounts, driver training incentives, and family plan bundles, which enable young drivers to save money. Moreover, insurers are increasingly emphasizing digital-first products, enabling young policyholders to make claims, payments, and renewals through mobile apps, which appeals to their technological nature.

1. Why Young Drivers Pay More for Car Insurance

Young drivers are statistically more likely to be involved in accidents, receive traffic tickets, and file claims. Insurance companies view them as high-risk clients, which leads to increased premiums. Factors influencing high costs include:

- Lack of driving experience

- Higher accident rates

- Tendency to drive more recklessly

- Lack of credit history (affects rates in some states)

Understanding these reasons helps young drivers and their parents take steps to reduce risks and qualify for discounts.

2. Top Car Insurance Companies for Young Drivers in 2025

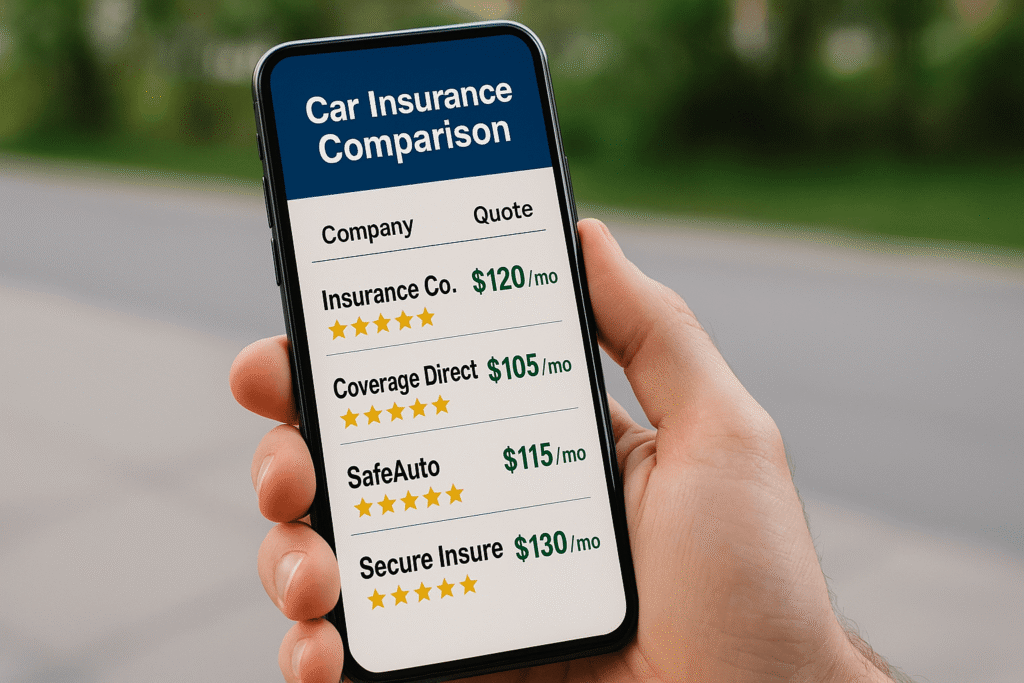

Here are the best-rated insurance providers for young drivers in 2025 based on affordability, customer satisfaction, and coverage options:

- GEICO: Offers low rates, excellent mobile app, and student discounts.

- State Farm: Known for its “Steer Clear” safe driving program for teens.

- Progressive: Offers usage-based insurance through the Snapshot program.

- Allstate: Features teenSMART program and accident forgiveness.

- Nationwide: Great for bundled policies and student discounts.

These companies are known for offering specialized plans tailored to younger drivers.

3. Cheapest Car Insurance Options for Teen Drivers

Teen drivers can significantly reduce their insurance costs by:

- Staying on a parent’s insurance plan

- Maintaining good grades (GPA-based discounts

- Driving safe, low-power vehicles

- Taking approved defensive driving courses

Teens should always compare quotes across multiple providers and look for companies that offer specific teen discounts.

4. Best Car Insurance for College Students (With or Without a Car)

College students may not drive daily, which can qualify them for lower premiums. Options include:

- Distant Student Discounts: For students attending school over 100 miles away.

- Non-Owner Insurance: Covers liability when borrowing a car occasionally.Telematics-Based Plans: Pay-per-mile or usage-based plans that track driving behavior.

Students should ensure they maintain continuous coverage, even if not actively driving, to avoid rate spikes in the future.

5. How to Lower Car Insurance Rates as a Young Driver

Several strategies can help reduce insurance costs:

- Complete driver education courses

- Choose a car with good safety ratings

- Avoid traffic violations and accidents

- Use telematics or usage-based tracking programs

- Increase deductibles to lower monthly premiums

- Bundle auto insurance with renters or home insurance

Our Previous Article : Smart Travel Protection Best 2025 Plans with Instant Payouts

6. Usage-Based or Pay-Per-Mile Insurance for Young Drivers

Telematics programs like Progressive’s Snapshot or GEICO’s DriveEasy use GPS and smartphone data to monitor driving habits. These programs reward safe behaviors like:

- Smooth braking

- Low mileage

- Driving during daylight hours

Young drivers who drive safely and infrequently may see major savings.

7. Best Cars for Low Insurance Premiums (Ideal for Young Drivers)

The type of car you drive heavily influences your insurance premium. Best choices include:

- Honda Civic

- Toyota Corolla

- Mazda3

- Subaru Impreza

- Hyundai Elantra

These vehicles are affordable, reliable, and have strong safety ratings, making them ideal for young drivers.

8. State-by-State Car Insurance Cost for Young Drivers (2025)

Insurance rates vary greatly by state due to local laws, accident rates, and minimum coverage requirements. Most expensive states:

- Michigan

- Louisiana

- Florida

Most affordable states:

- Ohio

- North Carolina

- Maine

Young drivers should research their specific state’s insurance laws and average premiums.

9. What Coverage Do Young Drivers Actually Need?

Minimum state coverage is often not enough. Recommended coverage includes:

- Liability Insurance (required by law)

- Collision Coverage (for repairs after an accident)

- Comprehensive Coverage (theft, vandalism, natural disasters)

- Uninsured/Underinsured Motorist Protection

It’s essential to find a balance between cost and adequate protection.

10. Common Mistakes Young Drivers Make When Buying Insurance

Avoid these common errors:

- Choosing the cheapest plan without enough coverage

- Not comparing quotes from multiple providers

- Ignoring deductible amounts

- Skipping driver safety courses

- Failing to ask about discounts

11. Best Apps and Tools to Compare Car Insurance Rates in 2025

Use these platforms to compare quotes easily:

- The Zebra (nationwide comparisons)

- Policygenius (insurance marketplace)

- Compare.com (real-time quote tools)

- NerdWallet (comparison plus financial advice)

Apps save time and offer side-by-side comparisons to help young drivers choose wisely.

12. Car Insurance Laws for Young Drivers in the USA

Every state has its own requirements. Common rules include:

- Minimum age and permit periods for teens

- Graduated driver licensing (GDL) systems

- Required liability limits

- Special provisions for high-risk drivers

Understanding these laws ensures compliance and avoids fines or policy cancellation.

Our Previous Article : Smart Travel Protection Best 2025 Plans with Instant Payouts

FAQs

Q1: What is the best insurance company for young drivers in 2025?

A1: GEICO, State Farm, and Progressive are top-rated for affordability and teen-focused programs.

Q2: How can I get cheaper car insurance as a student?

A2: Maintain good grades, stay on your parents’ plan, drive a safe car, and take a defensive driving course.

Q3: Should young drivers get full coverage?

A3: It depends on the vehicle value and financial risk. Full coverage is recommended for newer cars.

Q4: Are there apps that help compare insurance rates?

A4: Yes, apps like The Zebra, Policygenius, and Compare.com are helpful for real-time rate comparisons.

Q5: What’s the difference between liability and full coverage?

A5: Liability covers others in an accident you cause. Full coverage includes collision and comprehensive protection for your car.

Conclusion

In 2025, the best car insurance for young motorists in the USA is a policy that combines affordability, digital convenience, and significant discounts with robust coverage and customer services. With various players providing driver-centric benefits and more intelligent policy formats, young motorists now have more choices than ever before to get an affordable plan without sacrificing safety or protection.

Whether it’s through great student discounts, telematics-based discounts, or combining with a parent policy, smart decisions and careful shopping can get young drivers driving confidently both on the road and when it comes to insurance.

1 thought on “Best Car Insurance for Young Drivers USA 2025”